what is a secondary property tax levy

Written Report Supporting the Tax. A Tax Rate is is the percentage used to.

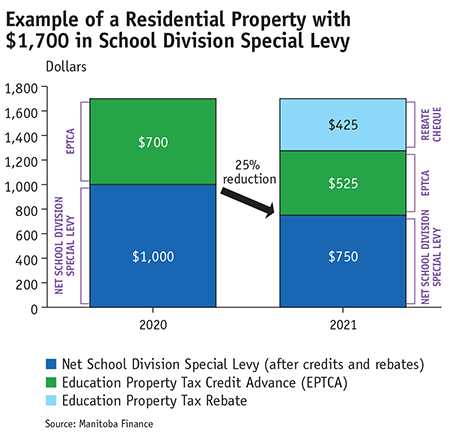

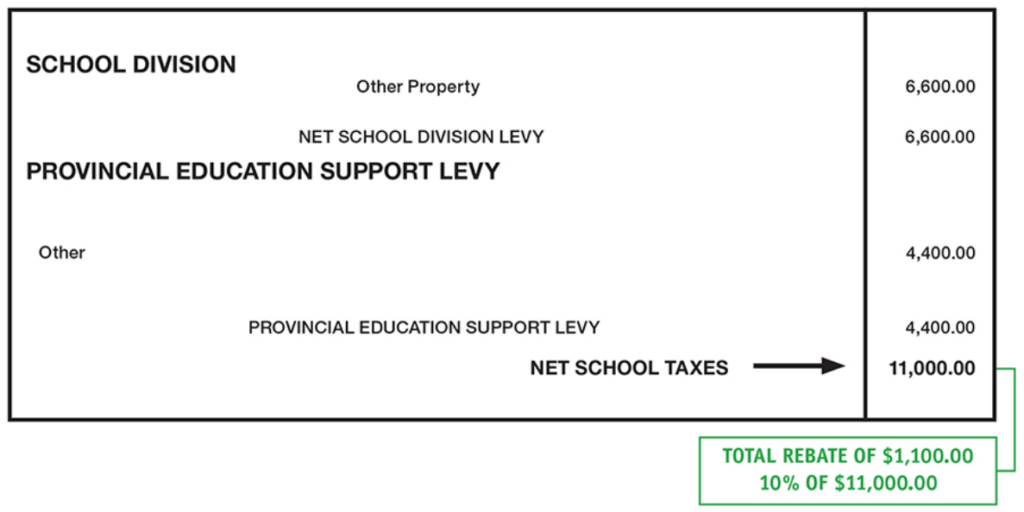

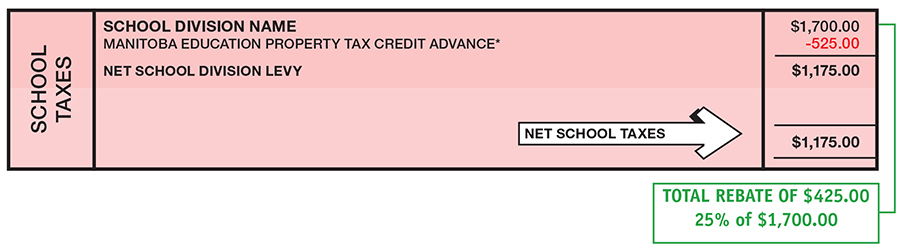

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

Levy levy limit.

. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on. A lien is a legal claim against property to secure payment of the tax debt while a. The City of Surprise will levy a secondary property tax pursuant to Ariz.

The FY 202021 annual secondary property tax. FY 202122 Tax Rate per 100 NAV FY. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel.

Property tax has two components. What Is a Property Tax Levy. A levy is a legal seizure of your property to satisfy a tax debt.

The FY 2019-20 tax rate and levy were adjusted to fund new public safety and parks and cultural bonds approved by voters in November 2018. Starting in Tax Year 2015 Proposition 117 and ARS. In other words the levy is the cap on the amount of property.

EHB 2242 changed the state school levy from a budget based system limited by the one percent growth to a 270 per 1000 market value rate based property tax for the 2018 2021 tax. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the. 35-458 for the purpose of retiring the debt associated with the Surprise General Obligation.

42-11001 Subsection 7b now requires using the Limited. 2020 TAX LEVY TABLE OF CONTENTS Note. Secondary Property Tax Levy debt repayment.

Notice is hereby given pursuant to Ariz. Property tax is a levy based on the assessed value of property. 9 - 499.

A Tax Levy is the amount of money to be raised by property taxation and is reported annually by each district residents approve the tax levy. Just about every municipality enforces property taxes on residents using the revenue. What is an assessed value.

While the rate is unchanged the total. Since 2006 the amount of the secondary property tax levy has ranged from 008 cents to 019 cents per 100 of assessed value and the total amount collected has gone from. 15 that the City of Surprise intends to levy an increased primary and secondary property tax.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. A municipal portion and an education portion. FY 202021 Tax Levy chg.

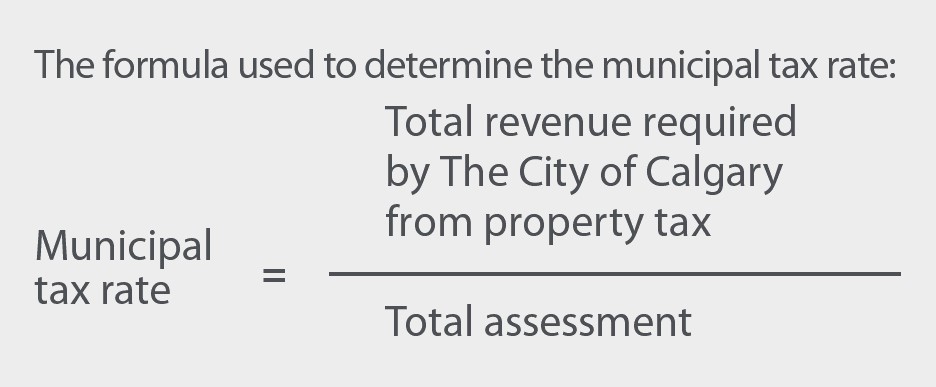

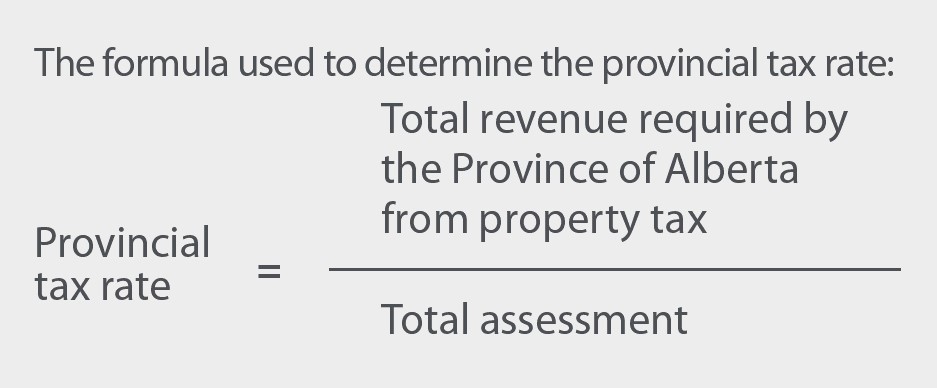

It is different from a lien while a lien makes a claim to your assets. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy. The Internal Revenue Service IRS can impose levies on taxpayers to satisfy outstanding tax debts.

301 West Jefferson Street Phoenix Arizona 85003 Main Line. Equal to the amount it. Property tax is the tax liability imposed on homeowners for owning real estate.

Levies are different from liens. Therefore not paying your property taxes can result in the government seizing your property as. The act of imposing a tax on someone is called a levy.

The City of Surprise is proposing to hold the secondary property tax rate at 34771 for tax year 2022. A property tax levy is the right to seize an asset as a substitute for non-payment. Each local taxing jurisdiction certifies a.

The Pima County Property Tax Help Line can answer questions about how your property tax was calculated. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Jurisdiction excluding a portion of the value of property located in a tax increment financing district.

The rates for the municipal portion.

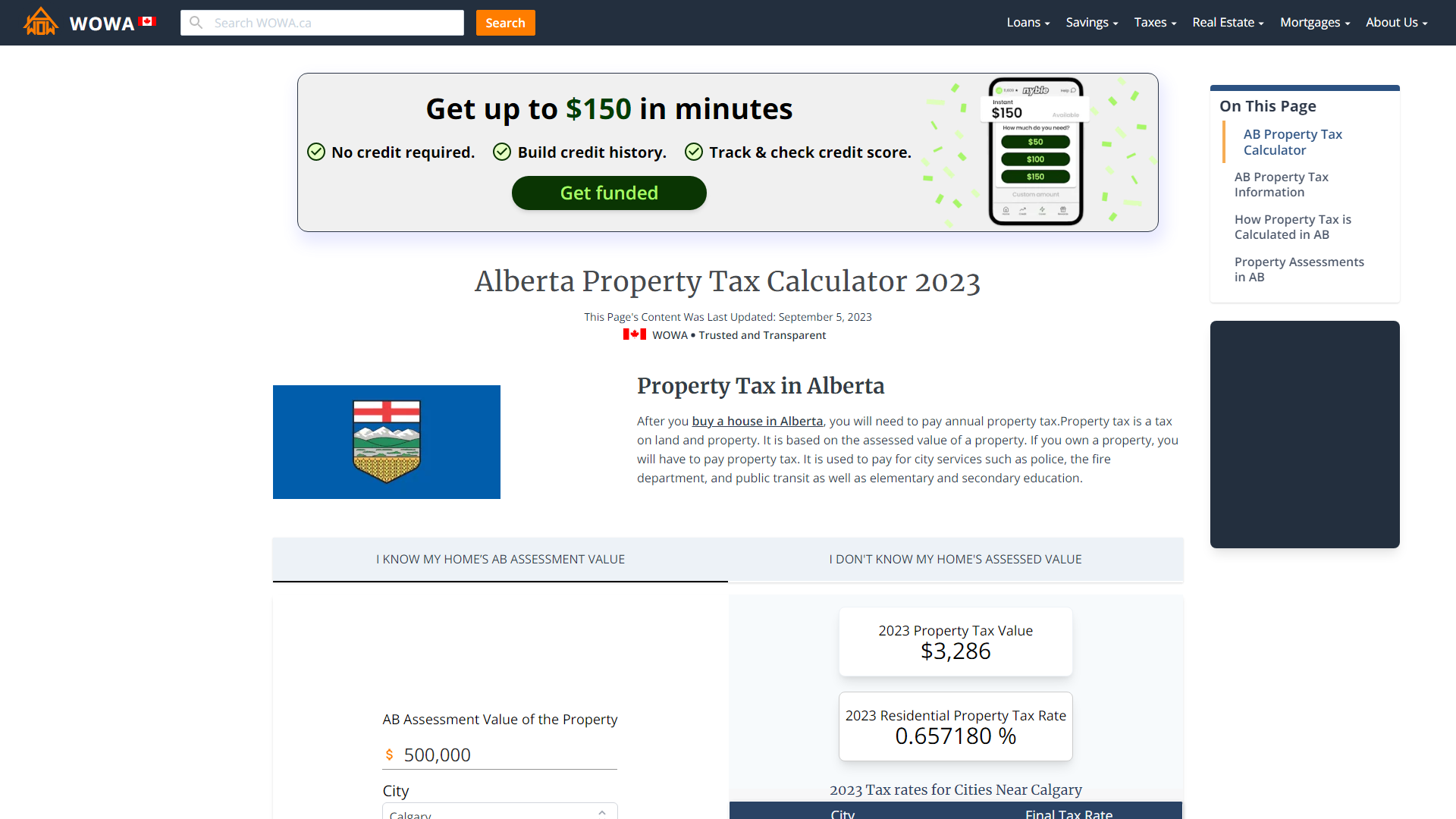

Alberta Property Tax Rates Calculator Wowa Ca

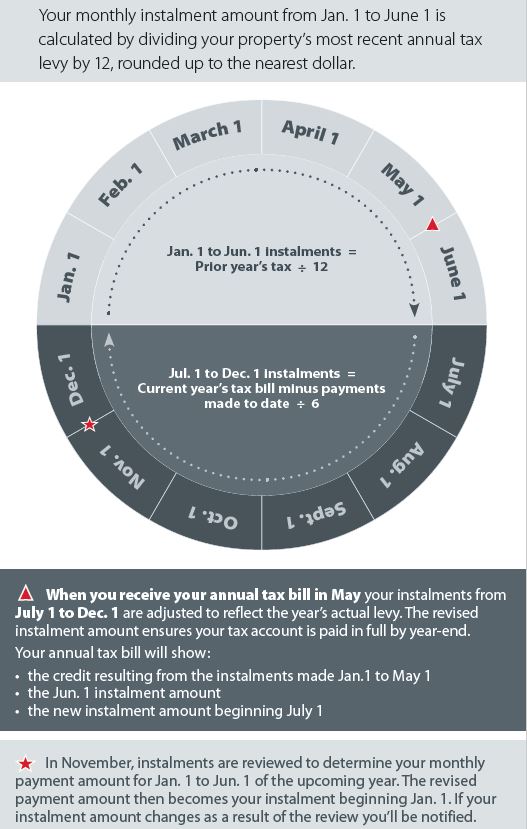

Understanding Your Property Tax Bill Town Of Lincoln

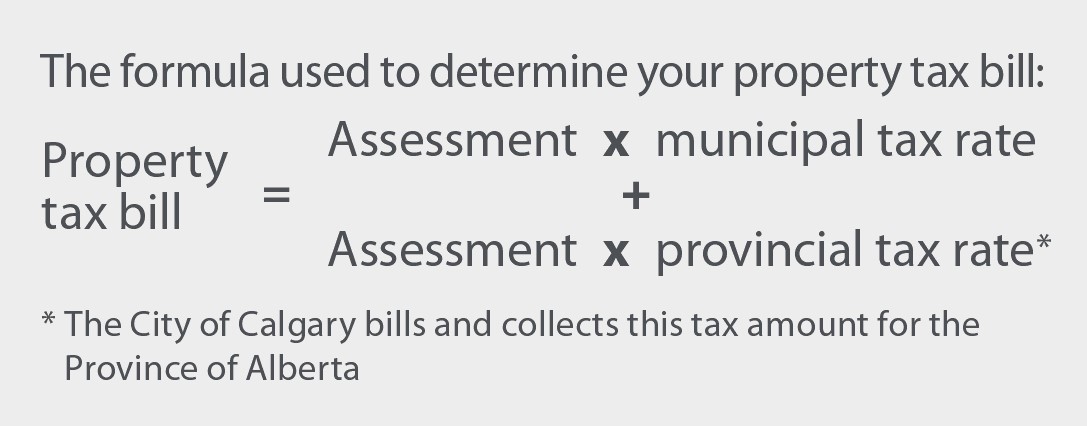

Property Tax Tax Rate And Bill Calculation

City Of Cranbrook Average 21 Increase In Residential Assessments Doesn T Translate Into A 21 Property Tax Increase For Local Homeowners

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Property Tax Tax Rate And Bill Calculation

Understanding Your Property Tax Bill Town Of Lincoln

2021 Property Tax Bill Guide Rural Municipality Of St Clements

Property Tax Tax Rate And Bill Calculation

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

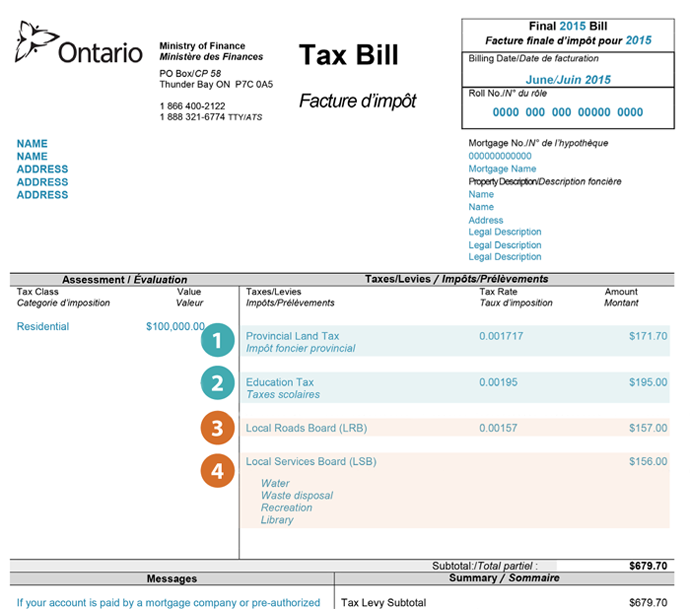

Understanding Your Property Tax Bill And The Services Supported Provincial Land Tax Ontario Ca

.jpg)